Results season has brought a fresh wave of AI enthusiasm but also some concerns about margins, with the key hyperscalers continuing to ramp up their capex in a familiar fashion to previous quarters. Much of this increase was justified by very strong operational performance, with Microsoft and Alphabet increasing their cloud revenues by 40% and 34% respectively, while Meta’s core advertising business grew 26%. This type of performance has been an integral driver of AI capex spending, with hyperscaler operating cash flows accounting for 60% of AI spend. Given the strong performance of the hyperscalers, this has given investors’ renewed faith that the beneficiaries of all this spending will continue to perform well.

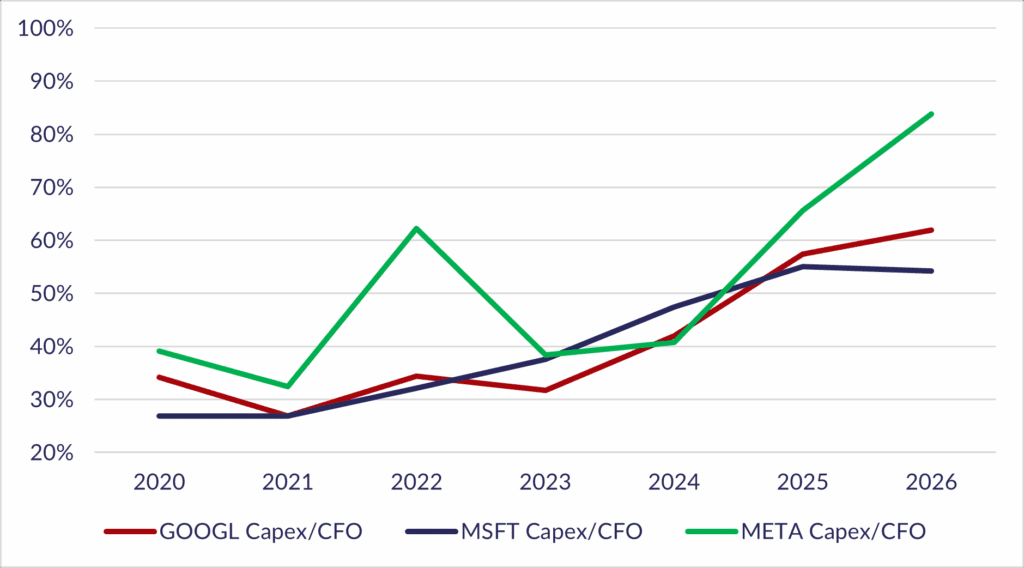

The numbers themselves certainly support this thesis, with Meta, Microsoft, Alphabet and Amazon expected to spend north of $480bn in capex during FY26, a number which many expect to ramp further as we close out the year. This is obviously a huge absolute figure, but a closer look at how it’s funded by operating cash flows provides a fresh perspective. The below chart illustrates this by showing each company’s estimated capex divided by their cash flow from operations, showcasing the increasing capital intensity over the past 3 years. What really stands out though is the significant jump from Meta, whose capital intensity is expected to more than double from ~40% to over 80% in FY26.

Source: Bloomberg

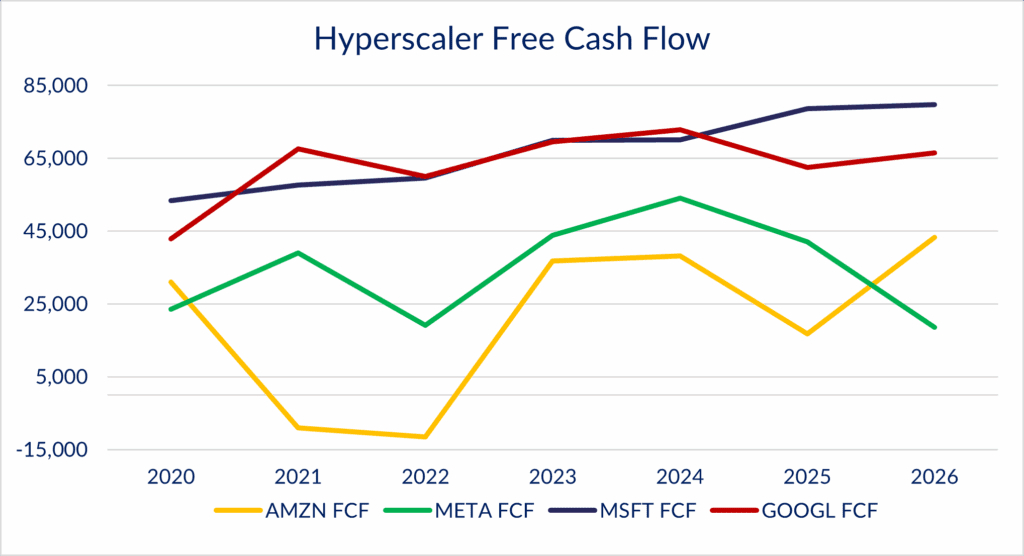

The scale of this commitment sent the shares down more than 11% post report, with many questioning the end goal of the AI spend and likening it to Mark Zuckerberg’s 2022 pursuit of the ‘metaverse’. This concern is not without merit, as the weight of spending is now starting to eat into the free cash flow numbers shown on the chart below. Again, what stands out here is Meta’s falling numbers against an expected increase for the other names during FY26.

Source: Bloomberg

Contrast with Alphabet, Microsoft and Amazon, whose cloud businesses are only limited by capacity and worthy of further investment, and it becomes clear why investors, including ourselves, have shifted from Meta into the other names. The next question is whether this combination of a slowing core business and increased investor scrutiny of spending is the first signal that the capex growth trajectory will slow. Given the importance of companies like Meta in the AI funding ecosystem, it would likely serve as an early indication of a pause in the AI trade and add to valuation concerns.

The response this results season marks a clear shift in mindset, with investors no longer viewing all capex as equal. Even with strong core businesses, the increasing capex intensity is beginning to play on investors minds where no clear road plan exists. While we view it as unlikely that the AI spending frenzy will end in the near term, this shift in sentiment gives us an indication of how the investment community might force the hyperscalers to rationalise their spending. As a result, the continued performance of the Mag-7 looks vital for AI momentum to continue and should be watched closely for any indications of an incoming demand air pocket. We remain underweight the Mag-7, but their impact on investment returns is impossible to ignore.

A PDF of ‘AI and the Capex Conundrum’ is available here.