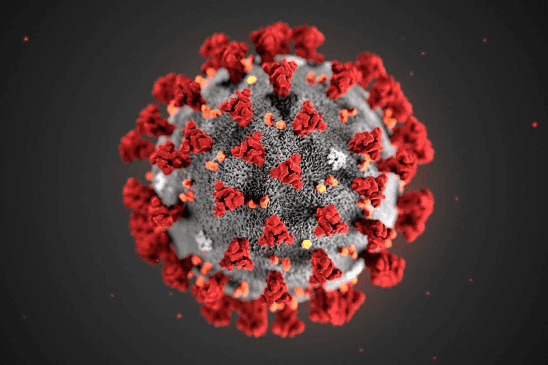

The recent pronouncement by the Federal health authorities that COVID-19 could spread more widely in the US has had a profound effect on markets. The China centric problem of a month ago has suddenly become a potentially global pandemic with a major slowdown in growth and recessions in many countries being forecast.

When the news from Wuhan first appeared, similarities were drawn with the SARS virus in 2003. As you will recall a similar fear gripped Hong Kong back then. The stock market shed 19% from peak to trough, only to recover all its losses by July of that year. Analogies with SARS however, are now being dismissed out of hand. We were told authoritatively at a conference the other day that, whilst SARS was more deadly than COVID-19, the latter is more easily communicable and therefore a far more profound threat to economic activity. At first glance this may seem to be a fair observation. In addition to his medical knowledge, the expert who told us this has a day job in credit default swaps!

Unlike him we are not experts in epidemiology, but what we would say is as follows:

- A central plank of our process depends on healthy balance sheets and strong cash flows. Our median holding is cash positive and cash flow return on operating assets is 35%, so we believe our portfolio is very well positioned to weather a hiatus in business of a quarter or two;

- There is no reason why any of the long term businesses in which we invest will be compromised by this, other than in the very short term, and some (e.g. online delivery of healthcare and education), will be positively and permanently enhanced; and

- Our early efforts at revising forecasts suggest there will inevitably be a hit to earnings this quarter, which will impact the year’s growth rates, so that the portfolio PEG will stray to the upper end of our range (approx.1.4x), but the rebound for next year will be much stronger and so the PEG will fall to 0.8x, i.e. the very bottom of the historic range.

In February the Fund fell 0.8% vs. the Index fall of 5.3%, and YTD we are down 0.3% vs. the Index fall of 9.7% and remember this is a portfolio which is over half invested in China.

Recently new cases in China have dwindled to a little over a hundred per diem, and only a handful in Hubei Province. It is estimated that around 80% of migrant workers had returned from Chinese New Year by month end, and one estimate put production back to 64% of normal, so China appears to be well through the worst. Whether the more liberal West deals with it so quickly remains to be seen.

Given the current negative sentiment, it may be too soon to consider adding to exposure. It is also clear that the growing number of quarantine precautions and business closures spreading around the world will have an impact that is difficult to calculate. However, whilst these precautionary measures may be unsettling they should surely be welcomed and, hopefully, will have a positive impact.

We have made no significant changes to the portfolio and remain confident that our investments are in good shape to weather this storm. Timing is everything, but towards the middle of the year markets will start to look towards 2021, and on that basis at today’s prices, our portfolio will be on record low valuations.

Please click here for a pdf version

This document has been issued by Aubrey Capital Management Limited which is authorised and regulated in the UK by the Financial Conduct Authority and is registered as an Investment Adviser with the US Securities & Exchange Commission. You should be aware that the regulatory regime applicable in the UK may well be different in your home jurisdiction.

This document has been prepared solely for the intended recipient for information purposes and is not a solicitation, or an offer to buy or sell any security. The information on which the document is based has been obtained from sources that we believe to be reliable, and in good faith, but we have not independently verified such information and no representation or warranty, express or implied, is made as to their accuracy. All expressions of opinion are subject to change without notice. Any comments expressed in this presentation should not be taken as a recommendation or advice.

Please note that the prices of shares and the income from them can fall as well as rise and you may not get back the amount originally invested. This can be as a result of market movements and of variations in the exchange rates between currencies. Past performance is not a guide to future returns and may not be repeated.

Aubrey Capital Management Limited accepts no liability or responsibility whatsoever for any consequential loss of any kind arising out of the use of this document or any part of its contents. This document does not in any way constitute investment advice or an offer or invitation to deal in securities. Recipients should always seek the advice of a qualified investment professional before making any investment decisions.