Aubrey’s Global Emerging Market (GEM) Strategy and Aubrey’s Global Conviction (GCF) Strategy are investing in pet sector companies. During 2025, we have added Gambol Pet Group (China) in GEM and Chewy (US) in GCF. The US market for pet products is mature with 70% of US households owning a pet while in China it is comparatively early stage with 22% household pet ownership.

The Aubrey strategies share the same fundamental bottom-up process resulting in high conviction portfolios of quality growth stocks. However, while the Global Conviction Strategy invests in US companies with considerable success, GEM focusses on domestic champions in emerging markets. Despite the different geographic focus, both strategies have found opportunities in the same sector which have undergone a period of normalisation since COVID and now look attractive.

The Chinese market is growing fast with household pet ownership increasing from 59 million to 187 million from 2010 to 2024 as disposable incomes have increased and, amid declining birth rates, there is a growing demand for animal companionship. As a result, the pet food industry is expected to grow at a CAGR of 7-12% over the next three years as pet owners become more educated and interested in higher quality products for their furry friends. This has led to increased demand for an increasing variety of higher quality products. Gambol is one of the leading players, but with only 6% of market share the opportunity for them to expand in the high growth environment is considerable and Gambol is targeting a market share of 15%. Gambol offers better value for money products than international players and is an established domestic brand.

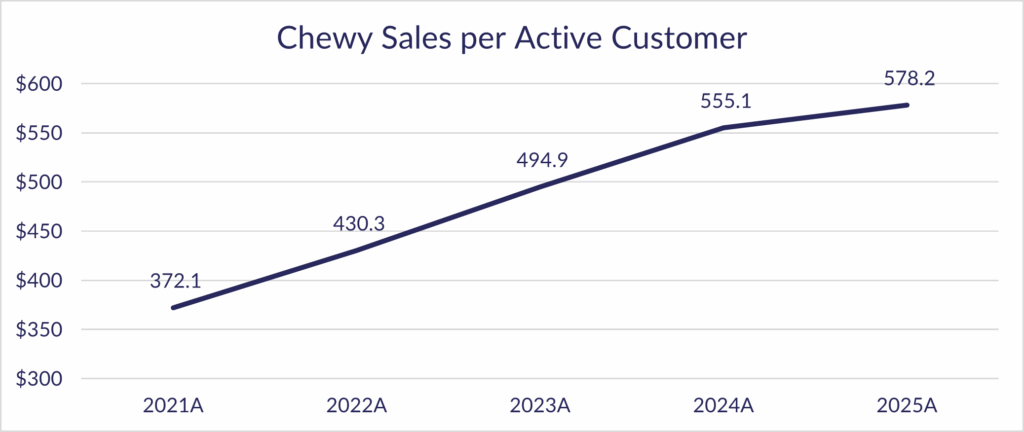

Contrastingly, pet ownership and the status of pets as members of the extended family is well established in the US (one friend living in Brooklyn New York shares an already cramped apartment with two emotional support animals belonging to their flat mates). There is a very different consumer dynamic with the average US pet owner spending $2,000 per year on their pet (vs. ~$300 in China), Chewy, a pure e-commerce play, has the largest pet product platform in the US and its competitive advantage is the scale of its well-established distribution network. Chewy’s Autoship function enables customers to schedule regular deliveries of food and other products ensuring a consistent and streamlined supply. As a result, Chewy’s growth stems from an increasing share of wallet as they expand into new verticals and product lines.

Eighty percent of Chewy’s sales are generated from the Autoship function, which gives a potential indication of where the Chinese pet sector is heading with e-commerce already accounting for 68% of China pet food sales. Gambol has demonstrated agility in adapting to rapidly evolving distribution dynamics and marketing trends. This is where the key growth opportunity lies, as an increasing proportion of younger consumers who lean into online channels become the next generation of pet owners. Millennials already make up the largest generation of pet owners in the US at 33%, with Gen Z also accounting for 16% despite their young age. This illustrates that the transition is already underway, with just under half of all pet owners in the younger, more digitally advanced cohort who skew towards online shopping.

The global pet industry underwent a period of outsized growth during the Covid pandemic, as pet adoptions surged and demand for pet products rose with it (both companies grew revenue over 40% during 2020). However, what came next was a significant normalisation, with pet relinquishments outstripping adoptions and pet share prices falling accordingly. Three years on, the timing now looks promising, with Chewy returning to customer growth for the first time since 2022, a key signal that we’ve reached a turning point.

Read the full ‘Barking Up The Right Tree‘ in PDF format.