How Crises Help Create Tomorrow’s Market Leaders

The GEM Strategy seeks to invest in high quality growth companies with reasonable valuations. However, it’s always interesting to see what else some of our most successful investment have in common, in order to identify future portfolio stars. Looking at the current portfolio, a number of our top performing names have each reinforced their leadership position thanks to a crisis.

^Crises force companies to rationalise costs and force weaker players out of the market, meaning profitability can explode when the crises end and demand or pricing power returns. This is why active management is essential, particularly during difficult times: the best companies get stronger, and others fall by the wayside.

Here are some examples in the current portfolio:

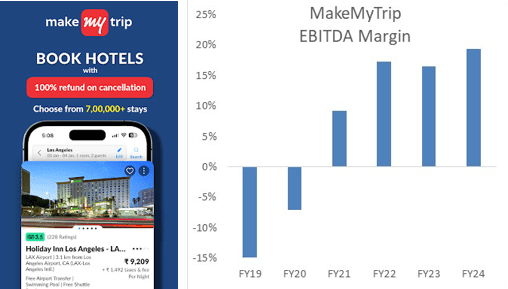

MakeMyTrip & Trip.Com

Both were the leading OTA (online travel agent) in their respective markets, India and China, before COVID-19. However, both faced significant competition, which limited profitability as they had to spend meaningfully on marketing. COVID-19 massively disrupted travel, hurting both businesses. However, while MakeMyTrip and Trip.com rationalised their cost bases, competitors were forced to leave the market or significantly reduce their marketing spend. As demand rebounded when travel returned, both were in stronger positions and saw their profitability reach new highs.

Source: Bloomberg

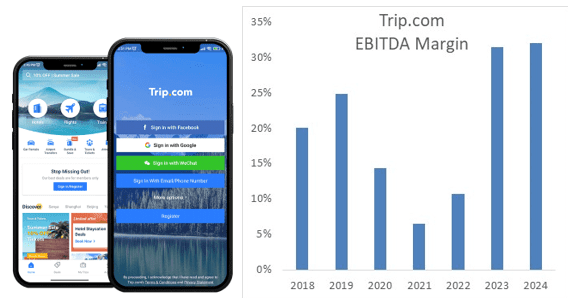

Bharti Airtel

The Indian telecom market was fairly fragmented when Reliance stormed into the space with their Jio brand in 2016. Offering significantly lower prices for consumers. Jio was able to leverage Reliance’s balance sheet and cash flow from established businesses (chemicals, oil and gas) to fund its aggressive market entry. Some players were forced to leave the market; others (Vodafone India and Idea Cellular) were forced to merge. Lower prices impacted Bharti’s profitability in the short-run, but the company was able to grow its market share (in what is now largely a two-player market), and pricing and profitability then followed. Given the struggles of the merged Vodafone business, India is now largely a two-player market – Reliance Jio and Bharti Airtel. Given Reliance eventually plans to separate the Jio business, it is likely to prioritise profitability going forward, which should support further earnings growth for Bharti Airtel.

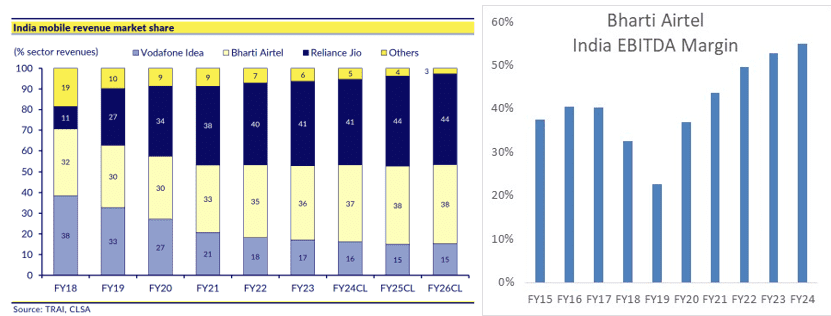

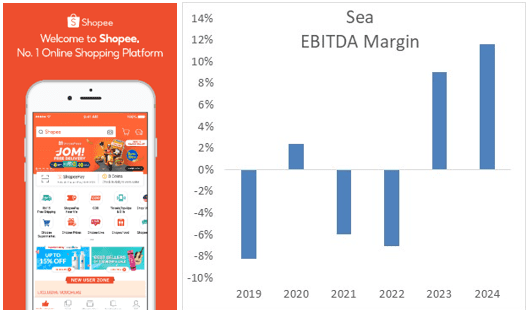

Sea

We first invested in Sea in early 2019,attracted by its model whereby its cash generative mobile gaming funded the development of its e-commerce business (“Shopee”). Given the size of the addressable market, the e-commerce industry in Southeast Asia has long been extremely competitive, with players willing to invest significant sums and operate at a loss to grab market share. As interest rates rose globally in 2022, many players were forced to become more rational with their investments, which has allowed leading players, such as Shopee, to demonstrate a significant inflection in profitability without impacting market share.

Given the growing uncertainty in markets we see a number of opportunities to invest in high quality growth companies with attractive valuations (just like those described above) which will emerge stronger from any future turmoil.