AI related stocks have driven much of the performance of the US and global stock markets year to date, with many of the key beneficiaries now trading at premium valuations, leaving investors questioning whether they’ve missed the boat. However, we still see plenty of opportunity in emerging markets to get exposure to this theme at a more reasonable price. In this article we look at three companies that should benefit from the AI revolution and where valuation is still compelling.

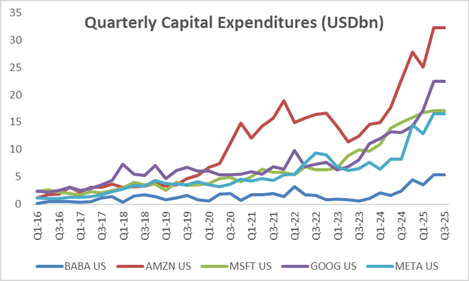

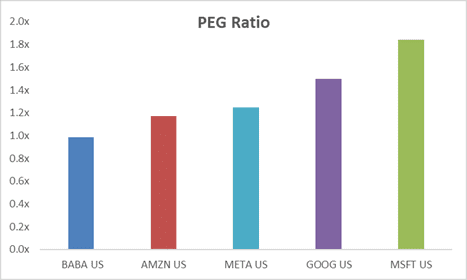

Alibaba is well known as a leading ecommerce player in China but is quickly becoming a global leader in cloud and AI with revenue growth for Alibaba Cloud accelerating to 26% YoY in Q2 2025 and the company’s Qwen AI model consistently ranked amongst the top large language models internationally. What is more remarkable is that the company has achieved this success with much lower capital expenditures than its US peers and, whilst the US hyperscalers struggle to access the power required for their growing datacentre pipeline, China has no such issues, leaving a clearer runway for growth. All of this comes at a much lower valuation than US peers, relative to growth, making this a good investment in our view.

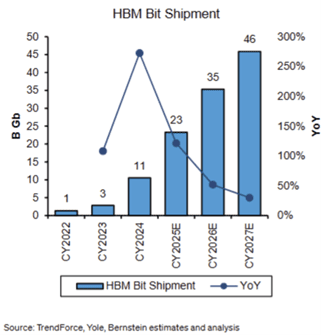

SK Hynix has built a market leading position in high bandwidth memory (“HBM”) – a form of dynamic random-access memory (“DRAM”) that is essential in AI applications as it eliminates the memory bottlenecks that enable faster data access and processing for complex models. Its lead in this area was so significant that it was the only company qualified to be used with Nvidia GPUs until recently. Increasing demand for HBM, which uses the same production facilities as traditional DRAM, has also lifted DRAM prices, providing an additional tailwind. We expect SK Hynix to remain the main supplier for leading edge HBM for the foreseeable future with demand accelerating in line with AI investments and newer generations of the technology attracting higher prices. Trading at just 7.7x next year’s earnings and 2.2x price to book, this remains attractively valued for the growth on offer, in our view.

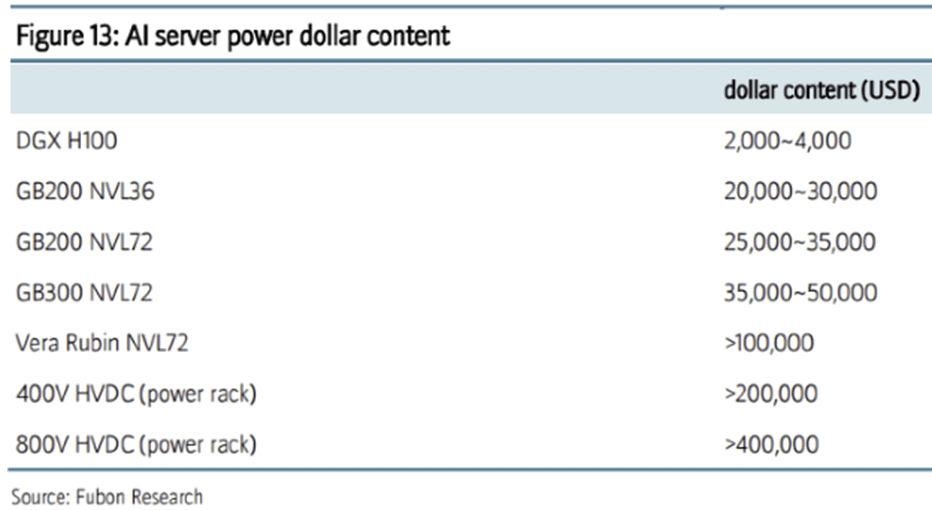

Another area being impacted by AI is power, which is significantly benefitting companies like Delta Electronics. The overall power consumption of proposed AI datacentre projects is immense, with, for example, projects announced so far under OpenAI’s Stargate Project requiring the equivalent annual power consumed by the whole of New Zealand1. This is partly due to the number of servers needed for AI development but, more importantly for Delta, is also driven by higher energy consumption per GPU as we move to new generations of Nvidia chips. This will require higher power connections within the datacentre, upgrades in terms of power architecture – including moving from in-rack power to separate power racks – and more efficient cooling to protect datacentres from overheating. Delta is a leading provider of technology in all these areas, which should allow the company to sustain high double-digit earnings growth for many years. Whilst the stock has rerated significantly YTD, it still trades at a PEG of less than one, which remains compelling in our view.

1 OpenAI’s Stargate Project has so far announced datacentres with power requirements of 15GW, which is equivalent to 131.4 TWh if used continuously over a year. New Zealand’s annual electricity consumption was c. 130 TWh in 2023.

Read our latest insight: “Emerging Market Tech Stocks Positioned for Growth” – click here to view the full PDF