2025 was a tale of two halves for the Aubrey Global Conviction Fund. Broader market performance in the first half favoured our highly active approach. However, the second half delivered the exact opposite.

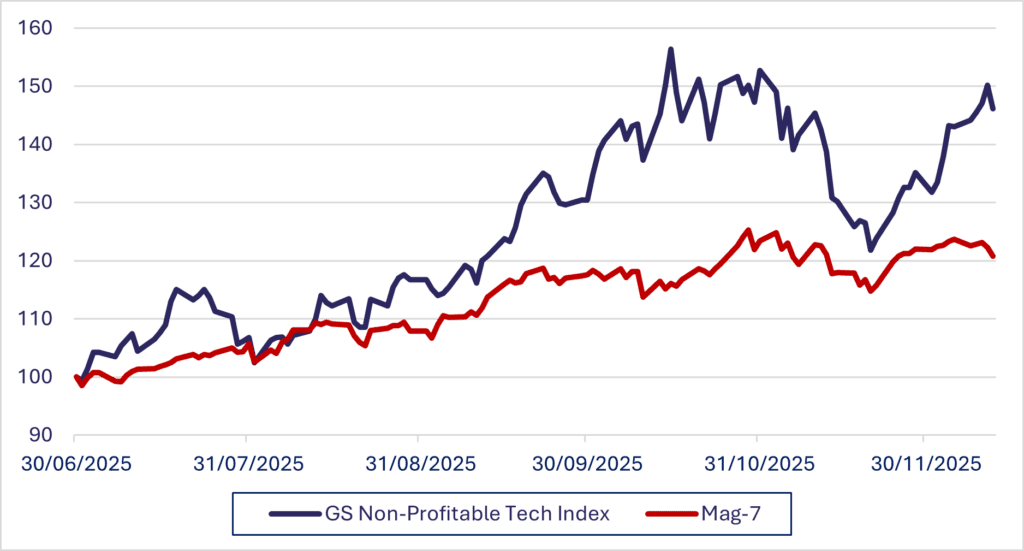

Digging deeper, the key themes that drove second half market performance were a sharp comeback for the ‘Magnificent 7’ (Mag-7) and what we view as a low-quality rally in tech. The chart below illustrates how meaningful these moves have been since the start of July, with the Mag-7 Index up over 20% and the Goldman Sachs Non-Profitable Tech Index up a staggering 46%. Many companies within the index do not meet Aubrey’s investment criteria of 15% ROE, 15% EPS growth and 15% CROA.

We are optimistic about the year ahead, with several key investment themes shaping up well for the strategy.

US: Time for a broadening?

Despite all the headlines over tariffs, inflation, tech valuations, and the path of interest rates, the US economy remains very resilient. Fiscal stimulus from the ‘Big Beautiful Bill’ should help to offset these impacts and support the private sector. Extensions to the 2017 tax cuts and exemptions for overtime and tips should help to bolster consumer spending, while depreciation and R&D incentives should encourage greater corporate investment. Accelerated depreciation should drive manufacturing investment and elevate the industrials sector, which was in the doldrums throughout 2025.

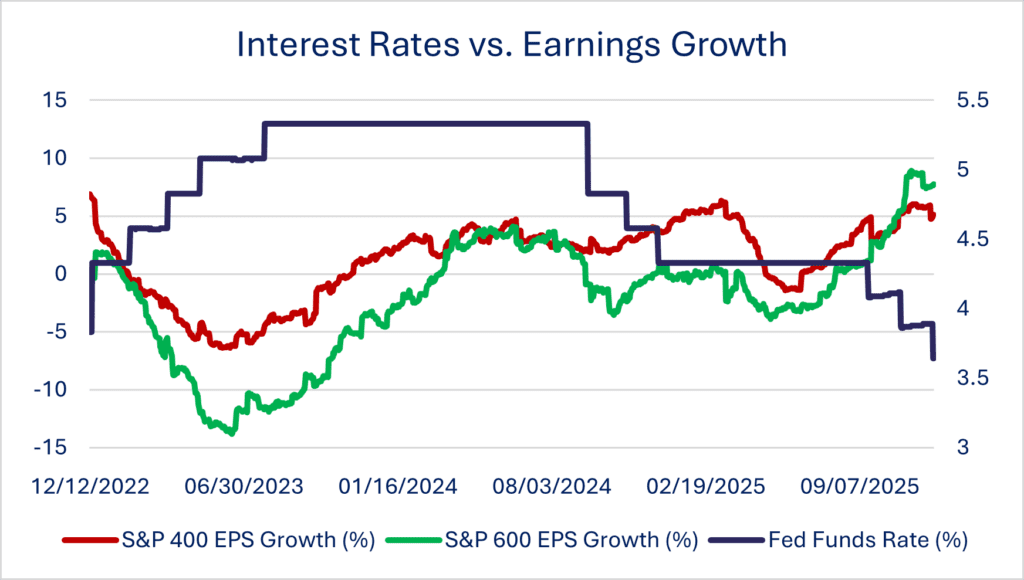

Additionally, the Fed’s rate-cutting cycle should benefit smaller businesses with more leverage, and ease pressure in the housing market as mortgage rates follow. The latter is of particular importance given that shelter accounted for 36% of the annual rise in CPI in September. For all the fanfare about tariffs and their inflationary impacts, shelter and other services remain a far more important factor than goods. As a result, we expect inflation to remain elevated but under control, which should support further rate cuts during 2026.

The upshot of this is a more positive outlook for the small and mid-cap space in the US, which has long been neglected and growth-constrained by the high-interest rate environment. Smaller companies use significantly more leverage to fund their businesses, suggesting there will be opportunities for margin expansion in a lower rate environment, reflected by a recent inflection in forward earnings estimates: Combine this with valuations in line with their 10-year averages, and we view it as an attractive opportunity for highly active stock pickers such as Aubrey (85-95% active share). Some of our most successful investments over recent years, such as Comfort Systems, Axon Enterprises and InterDigital, have come from the mid-cap space, and it’s an area where we feel we can add significant value for our investors.

Combine this with valuations in line with their 10-year averages, and we view it as an attractive opportunity for highly active stock pickers such as Aubrey (85-95% active share). Some of our most successful investments over recent years, such as Comfort Systems, Axon Enterprises and InterDigital, have come from the mid-cap space, and it’s an area where we feel we can add significant value for our investors.

This is not to say there aren’t still great opportunities in US large caps, where we still have some of the largest companies in the world, such as Broadcom and Alphabet. Many of these companies still meet our key criteria, but valuations for larger-cap companies appear stretched, and fundamental changes in the capex intensity of AI investments will continue to raise questions in 2026 and beyond.

The Elephant in the Room – What Next for AI?

As I’ve illustrated with my AI-generated ‘elephant in the room’ above, recent weeks have seen renewed concerns around extensive AI investments. Oracle has borne the brunt of this and is down almost 44% from its September highs following its announcement that it had a $300bn contract with OpenAI. The primary reason is that OpenAI cannot pay for these commitments currently, and Oracle has raised debt to fund the build out of data centres, effectively taking on their credit risk.

As I’ve illustrated with my AI-generated ‘elephant in the room’ above, recent weeks have seen renewed concerns around extensive AI investments. Oracle has borne the brunt of this and is down almost 44% from its September highs following its announcement that it had a $300bn contract with OpenAI. The primary reason is that OpenAI cannot pay for these commitments currently, and Oracle has raised debt to fund the build out of data centres, effectively taking on their credit risk.

Our takeaway from the past two months is that while capex was previously met with broad-based enthusiasm, this trend has been broken, and not all capex is created equal. Where companies such as the hyperscalers are using cash piles to invest, they are being rewarded, while those using debt are under severe scrutiny. Clearly investors are becoming more selective, and others such as CoreWeave and Meta have suffered similar fates with worries over financing and questions about monetisation. We wrote about this change in behaviour following our decision to sell Meta and expect questions will continue to grow throughout 2026.

Fortunately, the AI trade still looks solid in the near-term, with 60% of AI capex originating from Amazon, Microsoft, Alphabet and Meta, all of which increased their capex guidance for 2026 following Q3 results and are expected to do so again in January. This should shore up the fundamentals into the start of next year, but deeper questions remain about the speed of enterprise adoption and when the technology will be good enough to replace a wider range of the workforce. Our own in-house testing suggests AI saves time on data gathering but has limits on quality and accuracy for technical tasks.

Aside from basic process-based roles, AI in its current form cannot replace a human worker. While adoption has been staggeringly steep, with McKinsey reporting in November that 88% of organisations now use AI in at least one function, almost one third report inaccuracy as the primary issue they encounter. As a result, over 60% of these organisations are still stuck in the piloting or experimenting phase. Given we are now only 12% away from full adoption, the narrative has switched to how AI use cases can materially improve efficiency and the profitability of those using it. Should we see a deceleration in the impressive adoption curve, it will only raise fresh questions about the amount of money being invested in AI infrastructure.

We think 2026 will see renewed volatility in the tech space, with the Gemini vs. ChatGPT narrative set to heat up with Meta’s latest Llama model, the GPU vs. TPU debate will rage on, alongside the most important narrative of hyperscaler capex. We remain optimistic but cautious about the direction of travel and will be watching all these themes closely. We expect the performance of the tech sector to have a significant bearing on the rest of the US market, with any volatility used as an opportunity to rotate to the lesser-loved sectors that look attractive heading into 2026.

Emerging Markets: The Sleeping Giant Awakens?

2025 was a very strong year for Emerging Markets (EM), with the MSCI EM Index up over 30%. While much of this has been driven by AI enthusiasm, with IT-heavy indices in Korea and Taiwan dominating, we see room for broader upside during 2026.

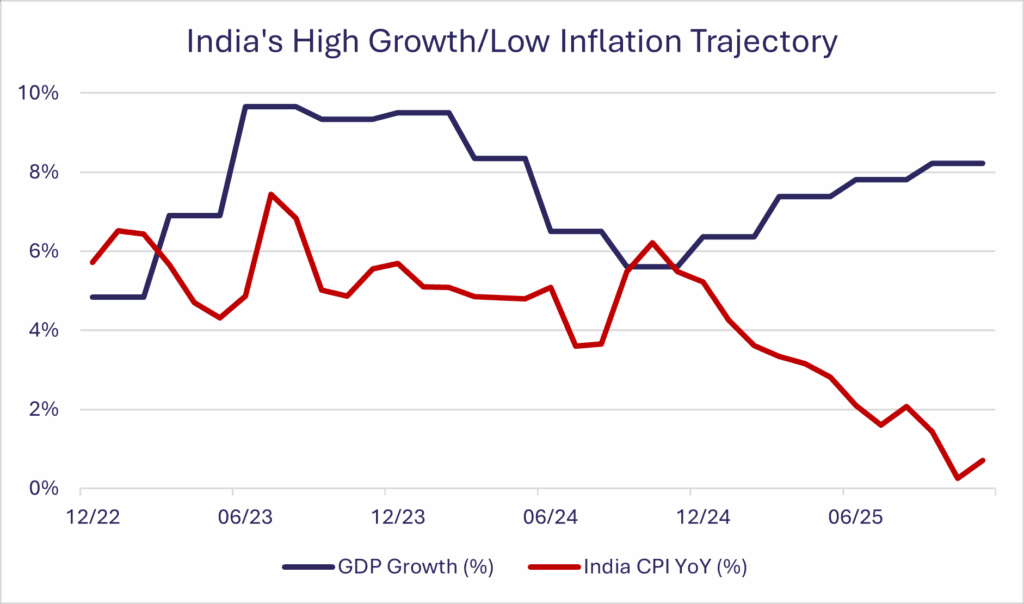

India remains the most compelling long-term investment opportunity in EM, with strong economic growth and subdued inflation setting the scene for 2026. India underperformed during 2025, likely serving as a source of funds for cheaper markets elsewhere, as well as the technology tailwinds previously mentioned in Korea and Taiwan. However, our conviction remains strong and GDP growth of over 8% in the second quarter serves to justify our thinking, while inflation remains comfortably under control. The Goods and Services Tax (GST) reforms implemented in September and the potential for further rate cuts by the Reserve Bank of India should also add further stimulus for the year ahead.

Latin America could become an increasingly attractive opportunity within emerging markets. Recent political changes with Milei’s election in Argentina in 2023 and the recent victory for José Antonio Kast in Chile suggest a move to more fiscally disciplined and market-friendly governments is sweeping the continent. Brazil has an election in October which could bring a credible centre-right candidate to rival Lula. Additionally, interest rates remain elevated at 15% and with inflation under control we could see the beginning of a cutting cycle which should support the overall economy and equity markets, which would give us more confidence to add to our existing Brazilian exposure.

Europe – The Second Act

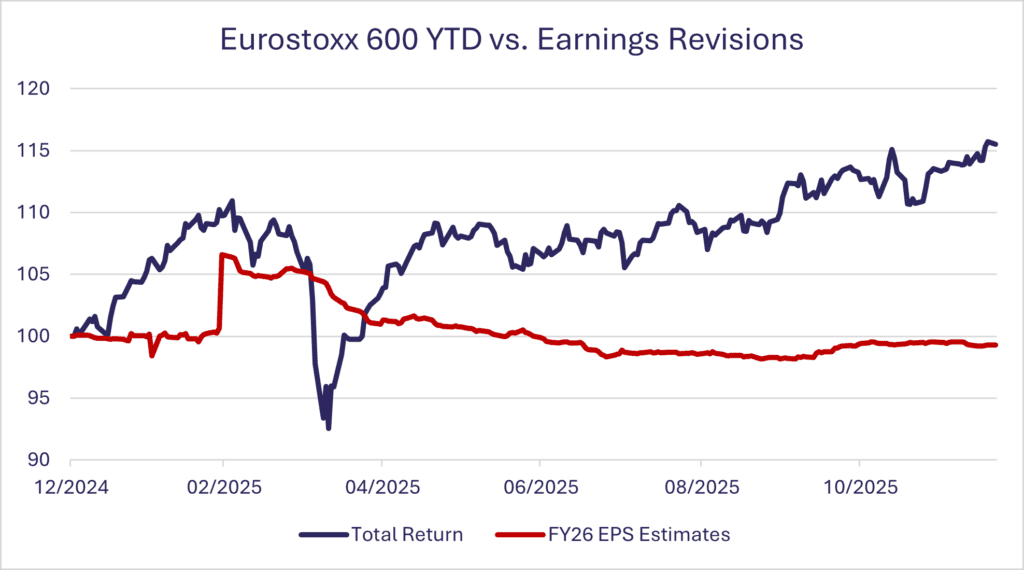

Europe has been a strong source of performance for the portfolio last year, led by Rheinmetall and Safran. It was a good year for Europe overall, with the Euro Stoxx 600 up over 21% in Euro terms, and Euro strength adding to returns. However, it feels as though Europe benefitted from a similar theme to China as an U.S. alternative at more reasonable valuations. The chart below illustrates this, with a steady uptrend for the index that hasn’t been matched by upward revisions to 2026 earnings numbers, meaning all the performance has been attributed to multiple expansion.

Sources for charts: Bloomberg

This is not to say there aren’t positives, with the German spending bill marking a significant shift to a more fiscally supportive environment which we hope other European nations may follow. Furthermore, a resolution to the Russia-Ukraine conflict could also support an improvement in sentiment. While the chart above doesn’t paint a pretty picture of revisions, expectations are still for about 10% earnings growth for 2026, a relatively high bar that we feel makes Europe more of a ‘show me’ story. We will therefore remain selective about the opportunities, in a similar vein to recent years.

Overall, there are ample opportunities across global markets for the year ahead that provide a constructive backdrop. We remain steadfast in our approach to finding high-quality growth companies, with a positive backdrop across EM and the resilient US economy giving us renewed conviction. We look forward to seeing how this year pans out and hope 2026 can be another good year.

A PDF of The Global Conviction Outlook 2026 is available here.