Samsung Electronics is the 4th largest constituent in the MSCI Emerging Markets Index (2.6% weighting as of the end of August), but it has struggled recently as it has fallen behind peer SK Hynix in its memory business and has seen its foundry business turn loss-making. However, we believe Samsung is at the start of a multi-year inflection.

Samsung Electronics’ two key businesses are semiconductors (memory and foundry) and electronic devices (mobile phones, TVs, etc.) which account for 84% of profits. The semiconductor business has been struggling of late, but we believe change is afoot.

The most important part of Samsung’s semiconductor business is memory. Memory is essentially electronic data storage (used in phones, PCs, servers, etc.) and historically the two key (relatively commoditized) elements have been DRAM (fast, temporary storage for active data) and NAND (slower, persistent storage for long-term data). Prices for commoditised memory can be highly cyclical, but DRAM has seen pricing inflect higher over the past few months (largely due to supply shortages as the industry has become more disciplined with capex) and NAND prices have stabilised, both of which are supportive for an improvement in Samsung’s memory profitability.

However, in the past couple of years, the memory industry has been dominated by a new, advanced form of DRAM: HBM (High Bandwidth Memory – a 3D-stacked DRAM designed for extremely fast data transfer), which has seen a huge increase in orders given the explosive demand for NVIDIA’s GPUs for AI applications. Samsung was the leading player in the 2nd generation of HBM, HBM2, but dropped the ball ahead of HBM3, which coincided with the take-off of AI. SK Hynix has since dominated the market, which, given the much higher profitability for HBM versus commoditised memory, has enabled SK Hynix to overtake Samsung’s memory profits for the first time. However, following meetings with management and other players in the supply chain, we believe they can regain share in the next generation, HBM4. Samsung has changed its management team for this division and has a differentiated solution for HBM4, which should lead to superior performance versus peers. If Samsung is successful in gaining a stronger foothold in this high-margin business, profits for its memory division should improve significantly.

The other part of Samsung’s semiconductor segment is its foundry business, in which Samsung manufactures semiconductor products for customers. Historically, Samsung has tried (and failed) to directly compete with TSMC in this business. However, management has pivoted recently and is now focused on being a credible second source for those customers that don’t want to be 100% reliant on TSMC. This strategy change has recently been rewarded with contract wins with both Tesla and Apple at Samsung’s facility in Austin, Texas. As capacity ramps, Samsung’s profitability in this business should positively inflect.

Outside of semiconductors, there are also attractive prospects for its mobile device business and its display panel business, both relating to foldable mobile phones. Samsung has recently launched next-generation foldable phones, which have been well-received. Furthermore, Apple is expected to follow by launching a foldable iPhone later this year. This is expected to use a Samsung panel and will increase awareness of foldable phones more broadly (positive for Samsung’s devices).

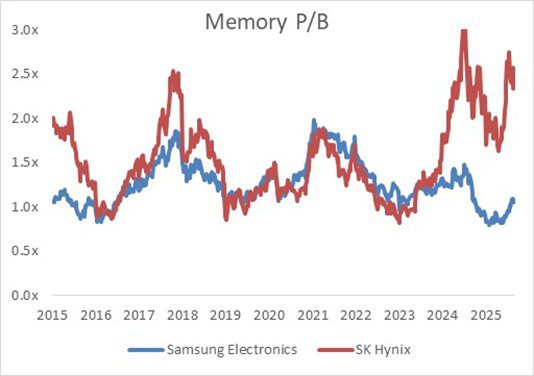

Despite the significantly improved outlook for Samsung, valuation multiples remain low relative to history, with the company trading at a significant discount as its nearest peer, SK Hynix.

Source: Bloomberg, 05/09/2025

A PDF of ‘Let The Memory Live Again’ is available here.