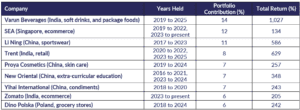

As the Aubrey Global Emerging Markets Opportunities Fund marks its 10-year anniversary we take the opportunity to reflect on some of our top performing stocks over the period:

Source: Bloomberg Port: 31 March 2015 to 31 December 2024.

What do these investments have in common?

To begin with, they must be in a business or industry which we expect to grow steadily for several years, in whichever country or region they operate. We focus on growth generated by the EM consumer, an exciting secular trend in emerging markets. As each country develops, consumer behaviour tends to go through the same patterns, which helps us to identify and predict growth opportunities. Something we often describe as being at “the sweet spot of growth”. SEA is a good example of this as it followed an ecommerce business model in Asia so successfully created by Alibaba a decade earlier in China.

It must also be the right company. This is often a leadership issue, or a first mover or other unique advantage. There is usually a reason why a company will grow much faster than the broader industry. Varun Beverages is such an example. Dramatic, multi-year growth was driven by taking over underperforming regions for its Pepsi products and narrowing the gap to where its better performing regional businesses were in terms of market share.

These attributes are reflected in the financial metrics we seek. Return on Equity (ROE) is an important reflection of a business’s strength and relative position. Our requirement is for a 15% ROE which we believe is realistic for well run businesses and a strong indication that they will at least cover their cost of capital. We also look for companies that have a 15% cash flow return on assets, which gives us confidence that they are able to support their growth from internal cashflow. Lastly, we want companies that can grow profits by 15%. Taken together our “three 15s” are a challenging set of metrics which mean our portfolio is stocked with high quality growth opportunities.

While identifying high-growth industries and strong companies is essential, knowing when to exit is just as important. Chinese educator, New Oriental, is a good example of a timely sell: partly because of valuation and partly as a result of growing government interference we sold the stock in early 2021 ahead of the truly draconian measures taken against the sector later in the year.

Read the full ‘Top 10 Emerging Markets Stock Picks Of The Past Decade’ in PDF format.