Welcome to 2025. I wanted to provide a brief outlook of what we think might happen to assets in the year ahead. The events of the last quarter of 2024, notably the election of Trump and the UK budget, led to substantial moves in both global and UK markets, and investors have continued to react to ongoing news and ramifications of both.

‘This is Trump’s world, and we all just have to live in it.’

Trump’s inauguration speech demonstrated that he wanted to hit the ground running. However, it’s worth remembering Presidential executive orders may sound impactful and powerful, but they can often be stymied by legal proceedings. The tiny Republican majority in the House of Representatives means that for Congressional approval, his policy actions may need to be more nuanced and restrained than MAGA rhetoric applies.

We have already seen progress in a peace agreement, driven by Biden and Trump’s envoy, in the Middle East. There has been a ratcheting up of Ukraine/ Russia fighting, and new oil sanctions on Russia, ahead of any potential ceasefire negotiated by the new administration.

The market enthusiasm around a Trump victory has somewhat receded. Trump said ‘tariffs are going to make us rich as hell’ but that’s not a common view. They are generally viewed as inflationary, and if they are enacted and do lead to price rises, this means that the Federal Reserve’s interest rate cutting cycle will come to an end. So far, Trump has talked about 25% tariffs on Canada and Mexico, but there seems to be some delay on a 60% tariff on Chinese goods – and suggestions of talks with President Xi at

some point. It’s likely that rhetoric will give way to pragmatism, and if policies are hurting the domestic economy rather than benefiting it, Trump may go easier on tariffs than expected.

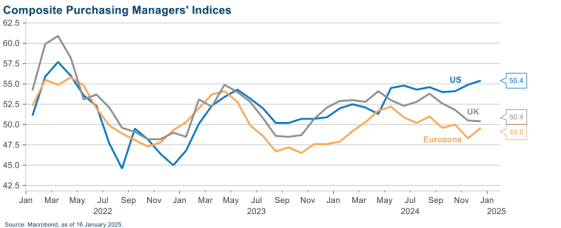

How to invest, given this backdrop? We remain optimistic about how good, nimble companies will navigate Trump 2.0. This chart shows that companies are feeling positive in the US – a number over 50 is seen as a positive indicator.

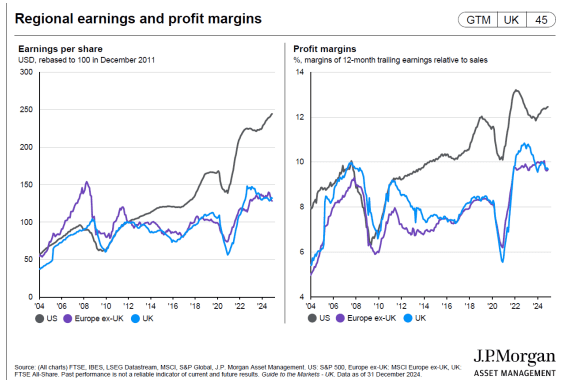

As can be seen from the following charts, earnings per share in the US and profit margins have remained strong and growing. The structural advantages of the US remain: their technological advantages, lower levels of regulation (and further deregulation has been promised by Trump) and the security and economy of energy supply. Cheaper oil and gas puts the US at an advantage – the US was already producing a record amount during the Biden administration.

Much has been made of the performance of the Magnificent 7 stocks, those companies with a market cap over $1tn, and they now make up a whopping 30% of the S&P 500, the index of the 500 biggest listed US companies. However, the rest of the market should continue to do well, and I remain positive on broad US equity exposure.

A Budget for Growth?

There has been quite the step down in confidence after Reeves’s budget on 30th October. Whilst the UK is not alone in terms of facing anaemic economic growth, the changes to the National Living Wage and employer National Insurance Contributions mean that wage growth is inevitable, and as a largely services-led economy, in turn, inflation is predicted to remain above target. This means that the Bank of England is unlikely to be able to cut interest rates as much as they might like, and this takes away

the boost that cheaper liquidity would normally give a struggling economy. We will need to keep watching inflation data closely.

To add insult to injury, the budget did not allow sufficient headroom for changes in market conditions, and on current borrowing costs the cushion has been wiped out. Bond watchers know the pressure Reeves is under and it seems that as well as spending cuts will be necessary but politically unpalatable. Sadly, tax rises are inevitable over 2025.

Where will the axe fall? Perhaps on Capital Gains Tax and an increase on fuel duty, should Reeves stick to her election promise not to hit ‘workers’ pay slips’. Investors will be marking their diaries for Reeves’s response to the Office of Budget Responsibility’s forecasts that are due at the end of March.

Hopefully Starmer’s proposals to ease planning restrictions will boost housebuilding and infrastructure activity, but this will take time to come through. The UK does face a challenging economic outlook, and this is reflected in valuations. Many UK blue chips do however pay good dividends and have exposure to overseas growth, so are appropriate for income-oriented investors.

The UK, and Europe more broadly, stands to benefit from a resolution in Ukraine, although pressure will intensify on those NATO members that do not spend sufficiently on defence to increase budgets sharply. France and Germany both face enormous political challenges this year, with the rise of populist parties, and fresh elections coming soon. It’s likely the European Central Bank will keep easing rates as inflation continues to fall back towards target. Economic growth rates will remain well behind those of the US, making the investment backdrop less favourable for companies heavily exposed to Europe.

In conclusion, we can already foresee that there are some significant events occurring this year that might move markets. Trump’s policy announcements, potential peace deals, the German elections, even Labour’s response to flagging economic growth – and those are the things we know about. Additionally, the path of interest rates is less predictable than investors might like or be accustomed to. Here’s to 2025!