Emerging Markets have long provided investors with an exciting opportunity for successful returns, and a portfolio diversifier. These are economies with relatively young populations benefiting from urbanisation, industrialisation, growing trade flows, and increased consumption. Combined they include six billion people and account for half of global economic growth, and are growing at a faster rate than their more developed counterparts.

However, over the past 10 years, the performance of broad-based emerging market indices has not reflected this opportunity. Investing passively in these markets is one way of guaranteeing disappointing returns and the question remains how to generate alpha over the long-term.

Domestic consumption will be a key driver of this alpha generation, although this is not just about access to basic goods and services. Emerging Markets are not homogenous; they include diverse countries at very different stages of economic development. For investors, the structural opportunity is to be found in consumer aspirations (better food, housing, transport, healthcare, education, and entertainment) as they become wealthier and have more disposable income. This trend is identifiable as, at around $3,000 GDP per capita, people tend to start eating out (India); at $5,000 – $10,000 there is better access to financial services (Indonesia); between $10,000 and $20,000 it is healthcare, retail and cars (Brazil, China); and over $30,000 it becomes foreign travel, technology and luxury goods (Korea, Taiwan). As these countries develop, companies that cater to the expanding urban middle class, people with higher education, formal employment opportunities and access to finance, are well-positioned for long-term growth, particularly those operating in countries with pro-business policies.

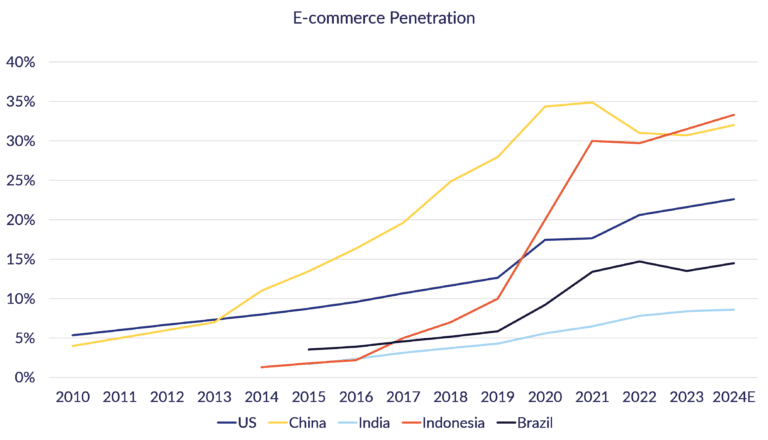

How the EM consumer makes purchases is also changing. Demand for organised retail space is increasing across India’s largest cities as formal retail gains traction. Access to technology has spurred the growth of e-commerce platforms.

Source: Aubrey Capital Management, Bank of America, 31 December 2024

There are over two billion Millennials and Gen Z consumers in Emerging Markets, spurring many companies to emulate the business model so successfully created by Tencent in China, SEA Limited in Southeast Asia or Mercadolibre in Brazil. E-commerce in India is just beginning.

Focussing on the consumer can also offer more predictability of outcomes, which in itself can leverage alpha opportunities. For example, it is much harder to predict the price of oil over the coming year versus the certainty that there will be more motorcycles on the roads of Emerging Markets. India’s motorcycle and car market continues to attract new customers.

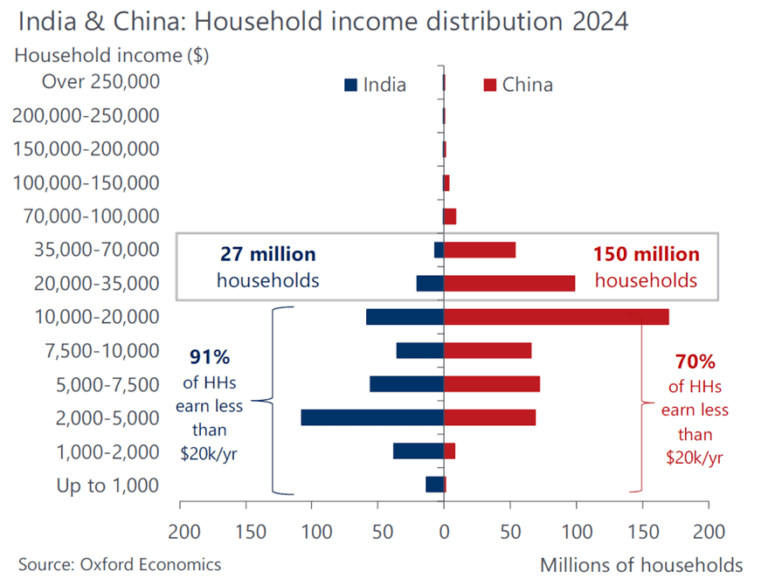

Over the next ten years, one of the overarching themes will be the emergence of India as the third largest economy, and the source of much of the world’s growth. The country is predicted to grow 6.7% annually over the coming years, with GDP per capita rising to $4,000 by 2029, representing a doubling since 2020. It is the secure middle classes that drive spending. The top 40% of the income bracket spends $600 billion per year and this is rising by some $50 billion per year. Comparing household income with that of China shows there is some way to go.

There is another key factor driving growth in Emerging Markets: the trade between them. Increasingly integrated and less dependent on the shipment of cheap manufactured goods to Developed Markets, data shows that from 1995 to 2022, this trade increased at an annual rate of 9.7%. In particular, intra-regional trade in Asia is approaching 60% of its total. Intra-Asia FDI is following suit with many companies building regional production capacity for higher-value products. Samsung in Thailand and Vietnam, Suzuki with local partner Maruti in India, and BYD in Indonesia being recent examples.

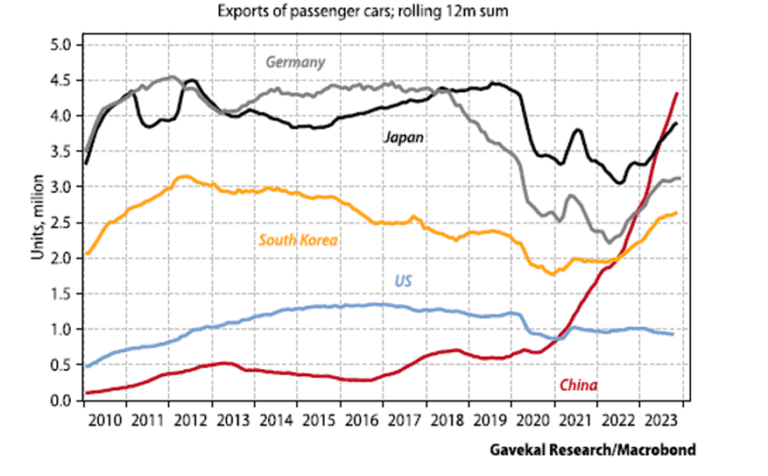

Chinese electric vehicles (“EVs”) are gaining traction throughout Southeast Asia because they are well built, competitively priced, and contain leading technology. These companies are also building local production capacity, reducing barriers to entry and the impact of cross-border tariffs. China is fast becoming an auto export powerhouse.

However, while a rising tide will lift all boats, as noted previously the broader EM indices have not necessarily reflected the ongoing opportunities. Investors need to be selective in the companies they choose. There is usually a reason why a company will grow much faster than the broader industry. For Aubrey, essentially these are companies with high returns, sustainable growth and strong cashflow (key to financing that growth).

With good active stock selection, the returns are there to be had even when the indices are pedestrian.

Read the full ‘What Do Emerging Markets Offer Investors?’ in PDF format.