My last note on the “Great US Equity Party” made the suggestion that it might be time to consider a bit of diversification into other equity markets. Perhaps unsurprisingly this stirred a range of responses. There were those who snorted derisively and shouted across the bar for more drinks. And who can blame them given the 16 years of handsome rewards in US equities. After all the signs that time is being called in the bottom right corner are hardly noticeable, even with beer goggles.

Source: Bloomberg, February 2025

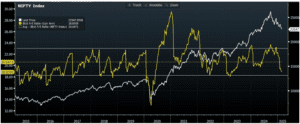

I did try to point out that both India and China enjoyed decent outperformance during Trump 1.0 as shown below:

Source: Bloomberg, March 2025

……..but this was drowned out by the clamour at the bar.

Others however, were more constructive. The jobs figure just out [on Friday] should qualify as a bit of an economic surprise to be baked into the CESI. Despite Jay Powell’s assurance that US growth remains solid enough to make any rate cuts in the near future unlikely, bond yields have dipped and US equities eased noticeably.

I would also point out that a retreating USD does make the prospect of rate cuts in one or two EM countries more likely as this would reduce the risk to their currencies should their central banks take such action.

Take these top-down comments for what they are worth.

But we are stockpickers rather than macro investors and the view from the bottom up in EM is throwing up some observations that are worthy of note.

First in India: the doubts over valuation that surfaced in Q4 last year were well founded. The NIFTY is down over 15% but more significantly its valuation is roughly 18x PE.

Looking at a decade of figures this has (Covid excepted) proved to be a reasonable entry point:

Bloomberg, March 2025

What I have been seeing in China is more anecdotal. Whilst not applying to the major cities, the relaxation of the hukou system must be seen as a significant measure to free up the movement of labour and therefore boost productivity in lower tier cities. A couple of the stocks we hold also caught my eye: first, Meituan, which has announced plans to expand the availability of insurance to their 120,000 odd drivers – government interference some might say, but all part of a campaign to restore confidence. Meanwhile BYD has raised over US$5bn to fund its development. Its growing domination of the Chinese vehicle market is well known but this war chest will clearly fund expansion in other countries outside the US. US tariffs are thus unlikely to have a significant effect.

Small beer perhaps but suggestive that Beijing’s goal of “common prosperity” is inching forward.

Authors

Mark Martyrossian | Director, Head of Distribution

Mark joined Aubrey in 2017, having known Andrew Dalrymple for several years whilst working in Hong Kong together.

Since 1987, Mark has been involved with Asian equities in a number of capacities. This began in equity sales before he established and managed a trading book for Crosby Securities in Hong Kong. He was also responsible for initiating a corporate finance business focused primarily on China. After the sale of Crosby Securities, he joined Warburgs with his China team. On his return to London, Mark founded a FCA registered fund management business with a number of Asian equity strategies. He managed that business until 2016 when he sold his interest.

Ben Shields | Investment Manager

Ben joined Aubrey in 2020 as one of the three co-managers of the TreeTop Global Horizon Fund, and now jointly manages the TreeTop Convertible International fund. He is also part of the team responsible for capital allocation within Emerging Markets for TreeTop’s third-party holdings. With a focus on fundamental research and growth assets, Ben contributes to idea generation for the Aubrey GEM Strategy.

Ben studied at King’s College, Cambridge, where he graduated with a degree in Economics. He then started his career in 2010 at Sanford C. Bernstein where he worked as an equity research analyst on the European Chemicals and European Building Materials sectors. He received the CFA designation in 2013. Ben moved to TreeTop in 2013 as an analyst (and later co-manager) of the Global Opportunities Fund.

Read the full ‘The Great US Equity Party: Part 2’ in PDF format.